Strategy

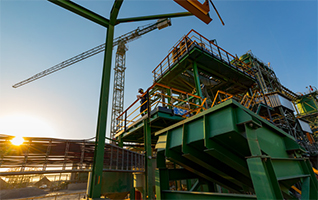

Tharisa’s core strategy is to generate value by becoming a globally significant low-cost producer of strategic commodities.

We meet global demand for our products through integrated mining, processing, marketing, sales and logistics operations.

The Group’s expansion strategy focuses on growth through value-accretive acquisitions and development of large-scale, low-cost projects that are in, or close to production.

DISCOVER

Tharisa seeks to grow and expand its

business by investing in operations or

projects which demonstrate opportunities

for value accretion. The Group proactively

seeks out investment or acquisition

opportunities in strategic commodities

and in countries offering geographic

diversity.

Tharisa seeks to grow and expand its

business by investing in operations or

projects which demonstrate opportunities

for value accretion. The Group proactively

seeks out investment or acquisition

opportunities in strategic commodities

and in countries offering geographic

diversity.

The Group gives preference to opportunities to develop large scale and low-cost projects that are in, or close to production. Such opportunities must meet Tharisa’s stringent investment criteria, including a minimum return on investment of 25%.

In FY2018, the Group diversified geographically by making low-risk entry options in two projects – Karo Holdings and Salene Chrome. Both are highly prospective opportunities on the mineral-rich Great Dyke in Zimbabwe.

DEVELOP

The Group has shown that it has the skills

to develop a mine from exploration

through to steady state operations. Its

phased approach to development has

derisked the current operations, allowing

it to look beyond its boundaries for its

next low-cost, large-scale operation. Its

innovative approach has ensured

continual improvement through

increased volumes and recoveries at

its operations.

The Group has shown that it has the skills

to develop a mine from exploration

through to steady state operations. Its

phased approach to development has

derisked the current operations, allowing

it to look beyond its boundaries for its

next low-cost, large-scale operation. Its

innovative approach has ensured

continual improvement through

increased volumes and recoveries at

its operations.

PGM recoveries at the Tharisa Mine have improved from 48.8% in 2014 to 82.1% in 2019 and chrome recoveries of 62.0%.

At Tharisa Minerals, the Vision 2020 projects aim to deliver 200 kozpa of PGMs and 2.0 Mtpa of chrome concentrates in 2020, on an annualised basis.

DELIVER

Tharisa continues to explore ways to

expand its marketing and sales

capabilities to enable the Group to

capture additional margin by leveraging

its existing capability, experience and

relationships through third-party sales

and logistics. Tharisa effectively competes

with other commodity traders based on

its tailored and high-quality service

offering, market knowledge and strong

customer relationships.

Tharisa continues to explore ways to

expand its marketing and sales

capabilities to enable the Group to

capture additional margin by leveraging

its existing capability, experience and

relationships through third-party sales

and logistics. Tharisa effectively competes

with other commodity traders based on

its tailored and high-quality service

offering, market knowledge and strong

customer relationships.

DISCIPLINE

With management of costs and improved efficiencies, Tharisa continues to be positioned in the lowest cost quartile for both PGM and chrome concentrates.

The Group subscribes to a capital allocation framework where potential projects are assessed against stringent investment criteria. The basis for the framework is investment in low-risk entry points and the staged capital investment and development of new projects.

Tharisa is cash flow positive, which has allowed it to maintain its returns to shareholders. The company has a dividend policy of distributing a minimum of 15% of consolidated net profit after tax. It declared an interim dividend of US 0.50 cent per share in FY2019. A final dividend of US 0.25 cent per share was proposed, resulting in a proposed total dividend of US 0.75 cent per share for FY2019.

DIVERSIFY

Strategically adding development projects to the portfolio that will ensure diversification while maintaining the focus on being a mechanised, low cost miner and beneficiator of metals.

We will use technology as our enabler and as our differentiator.

TOTAL PROPOSED DIVIDEND FOR THE YEAR

US$ 0.75 cents per share